When it comes to managing our finances, one crucial aspect is reconciling our bank accounts to ensure that we don’t spend more than we actually have. Reconciling a bank account involves comparing our personal records with the bank’s statement to identify any discrepancies and make sure everything adds up correctly.

To start, I’ll gather all my financial documents, including bank statements, receipts, and any other records of income or expenses. Next, I’ll carefully analyze each transaction on my bank statement and compare it with my own records. This step helps me identify any errors or unauthorized charges that may have occurred.

Once I’ve identified any discrepancies, I’ll take action to correct them. For example, if there are any incorrect charges or fees on my statement, I’ll contact the bank immediately to dispute those transactions. Additionally, if there are any missing transactions in my records but appearing on the statement, I’ll make note of them for further investigation.

For more interesting content, check out our next page!

Lastly, after ensuring that all transactions are accurately reflected in both my records and the bank statement, I can confidently reconcile my account by adjusting my balances accordingly. By regularly reconciling my bank account and staying vigilant about tracking expenses and incomes accurately, I can avoid overspending and maintain control over my financial well-being.

Reconciling a bank account is an essential practice for anyone looking to manage their finances effectively. It provides peace of mind knowing that our spending aligns with what we actually have in our accounts while also helping us detect potential errors or fraudulent activity promptly. So take the time to reconcile your bank account regularly – your financial health will thank you!

How Would You Reconcile Yo How Would You Reconcile Your Bank Account To Avoid Spending More Than You Have?

How Would You Reconcile Your Bank Account To Avoid Spending More Than You Have?

Bank reconciliation is a crucial process that allows you to ensure the accuracy of your bank account balance and avoid overspending. It involves comparing your records with those of your bank to identify any discrepancies and reconcile them. Let’s dive into how you can effectively reconcile your bank account to prevent spending more than you have.

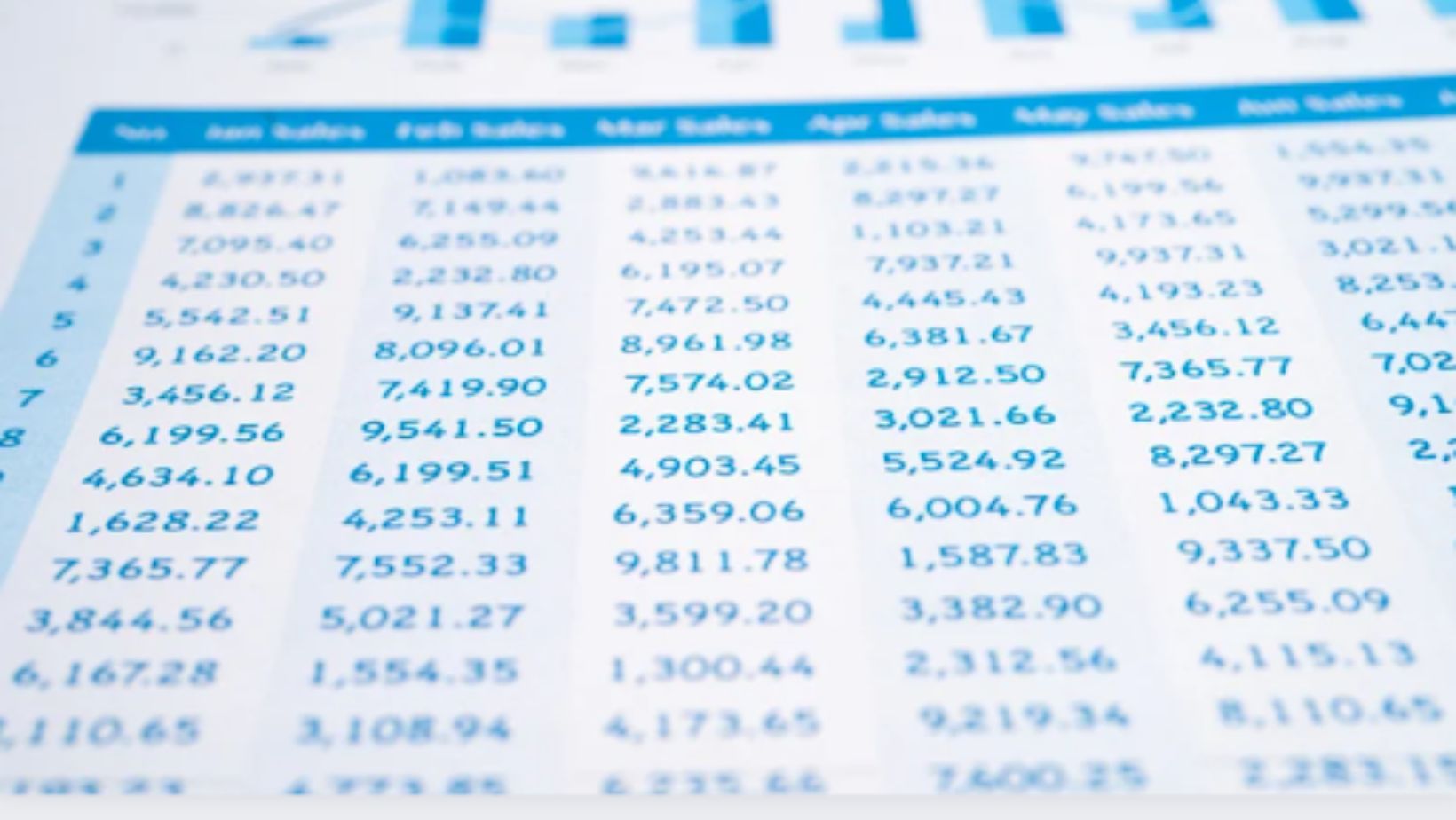

- Gather all relevant information: Start by collecting your bank statements, canceled checks, deposit slips, and any other financial documents that pertain to your account. This will serve as the foundation for the reconciliation process.

- Compare transactions: Carefully analyze each transaction listed on both your bank statement and in your personal records. Make sure they match up accurately, taking note of any discrepancies such as missing or duplicate entries.

- Identify outstanding items: Look for any outstanding deposits or checks that haven’t been cleared by the bank yet. Keep track of these items separately as they may affect the final balance.

- Reconcile deposits: Begin by reconciling the deposits between your records and the bank statement. Ensure that all deposits made are accounted for, including cash, checks, and electronic transfers.

- Reconcile withdrawals: Move on to reconciling withdrawals or expenses from your account. Verify that each withdrawal matches an expense recorded in your personal records.

- Consider fees and interest: Take into consideration any fees charged by the bank or interest earned on the account during the reconciliation process. These additional factors can impact the overall balance.

- Adjustments: If there are differences between your records and those of the bank, it’s essential to investigate further to identify errors or omissions from either party involved in the transactions.

- Finalize reconciliation: Once you’ve identified all discrepancies, make adjustments accordingly in both sets of records until they align perfectly—a balanced ending balance indicates successful reconciliation.

By following these steps diligently, you can reconcile your bank account effectively and avoid the risk of overspending. Remember to conduct regular reconciliations to stay on top of your finances and maintain accurate records.

How Would You Reconcile Your Bank Account To Avoid Spending More Than You Have?

How Would You Reconcile Your Bank Account To Avoid Spending More Than You Have?