How to Find Flexible Budget

As someone who’s been through budgeting, I can tell you firsthand that sticking to a plan can be easier said than done. Unexpected bills, emergencies, or just a change in spending habits can throw a wrench in your plans. That’s why having a flexible budget can adapt to your changing financial situation is important.

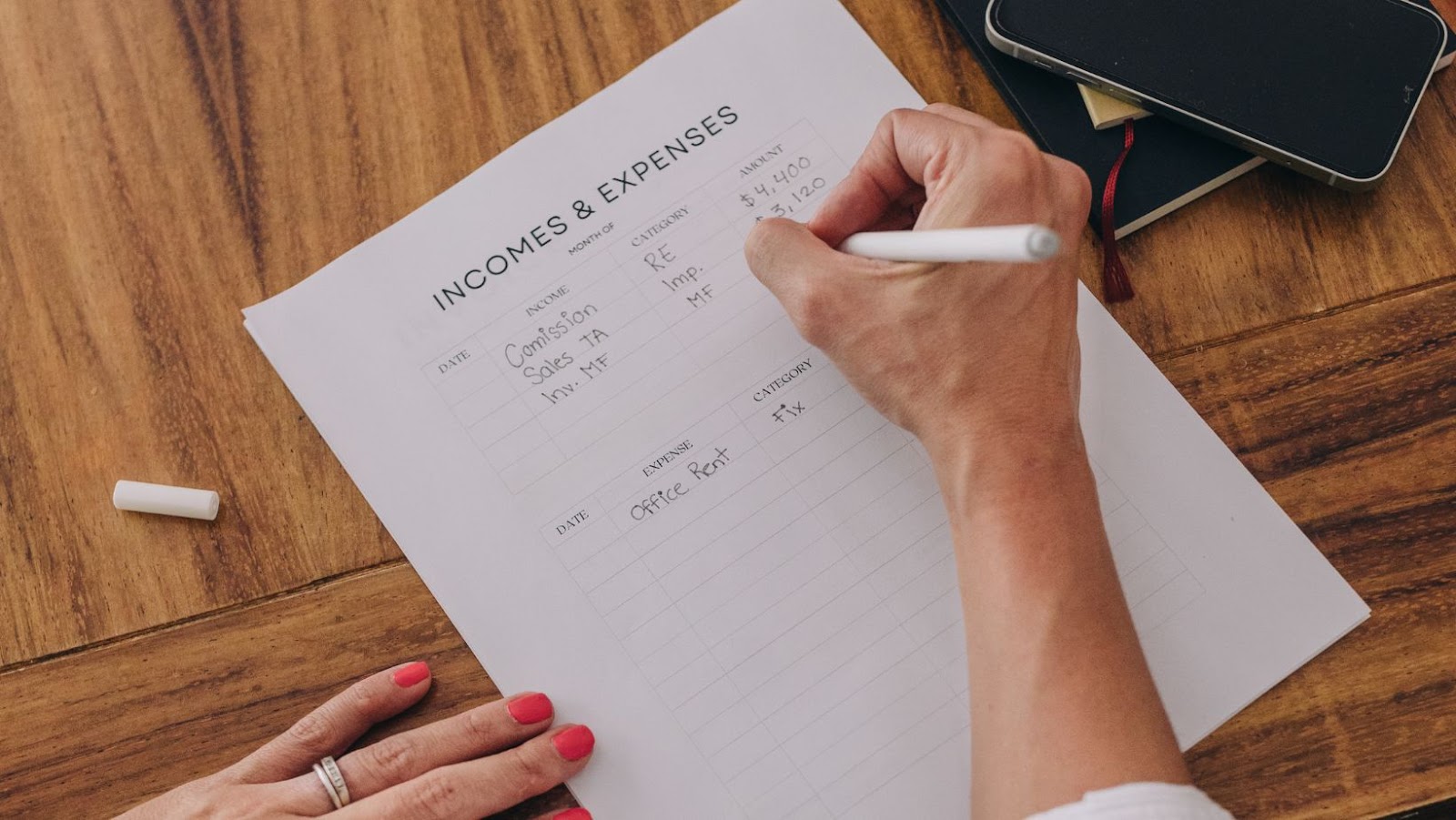

If you’re wondering how to find a flexible budget, the first step is to look at all your expenses and income. First, list all the bills you must pay each month, such as rent/mortgage, utilities, car payments, and insurance. Then, see if you can group your other expenses into groceries, entertainment, and transportation categories.

Next, determine your income and how much you make each month. Then, subtract the total of your bills and necessary expenses from your income, and see how much you have left over. This amount can be used for savings or discretionary spending categories.

To make your budget more flexible, consider setting up a separate emergency fund that can be tapped into in case of unexpected expenses. Additionally, having some wiggle room in your discretionary spending categories may be helpful to adjust as needed without completely derailing your budget.

By analyzing your finances and creating an adaptable budget, you’ll be better prepared to handle any financial curveballs that come your way.

Developing a Realistic Budget Plan

Developing a realistic budget is a crucial step when finding a flexible budget. Here are some tips to create a realistic budget plan that can adapt to your changing financial needs:

- Assess Your Current Financial Situation: Start by examining your current financial situation. Take stock of your income, expenses, debts, and savings. Determine how much you can afford to spend each month.

- Prioritize Your Expenses: List your regular monthly expenses and prioritize them. Make sure to cover necessities like food, rent, and utilities first, then allocate remaining funds towards discretionary spending.

- Consider Planned and Unexpected Expenses: Anticipate or plan for larger expenses, such as car repairs, home maintenance, or medical bills, by setting aside some monthly money. Also, save for unexpected expenses like emergency car repairs or home repairs.

- Use Budgeting Tools: Budgeting tools like spreadsheets, online budgeting tools, or budgeting apps to help you determine your income and spending patterns. These tools can help you better track and manage your finances.

- Be Flexible and Adjust as Needed: Remember to be flexible with your budget and adjust as needed. Life changes, and your budget should reflect that.

By following these simple steps, you can develop a realistic budget plan that can easily be adapted to your changing financial needs. It’s important to regularly evaluate your budget and adjust as needed to ensure you always have a flexible budget that best fits your needs.

Identifying Your Budget Priorities

The first step when finding a flexible budget is identifying your budget priorities. This means understanding your financial goals, needs, and limitations. Here are some tips on how to do it effectively:

Determine Your Income and Expenses

The first step is to determine your income and expenses. You should clearly understand how much money you earn each month and how much you spend on bills, groceries, rent or mortgage, transportation, entertainment, and other expenses.

Prioritize Your Expenses

Once you’ve determined your expenses, you need to prioritize them. This means deciding which expenses are essential and which you can do without. For example, your mortgage or rent, utilities, and groceries are likely essential expenses, while eating out or buying new clothes may not be.

Define Your Financial Goals

To find a flexible budget, you need to define your financial goals. This can include saving money for a down payment on a house, paying off debt, starting a retirement fund, or traveling. Knowing your financial goals will help you prioritize your expenses.

Create a Budget

Now that you clearly understand your income, expenses, priorities, and financial goals, it’s time to create a budget. This involves allocating your income to your expenses, based on their priority. Make sure to leave some room for unexpected expenses.

Monitor and Adjust Your Budget

Your budget is not set in stone. You should monitor it regularly to ensure you’re sticking to it, adjust it as needed, and make changes when your financial situation changes. You can use budgeting apps, spreadsheets, or financial planners to help you stay on track.

Following these tips, you can identify your budget priorities and find a flexible budget that suits your unique financial situation. It takes time and effort to create a budget that works for you, but the payoff is worth it in the long run.

Exploring Flexible Budgeting Strategies

When it comes to finding a flexible budget, there are a few strategies that I have found to be effective. Here are some tips on how to find a flexible budget:

Analyze Your Spending Habits

The first step in finding a flexible budget is to analyze your current spending habits. This means looking at your past expenses and identifying areas where you can cut back. By creating a budget and tracking your expenses, you can better understand your financial situation and make adjustments accordingly.

Consider a Zero-Based Budget

A zero-based budget is a strategy that involves allocating your income towards expenses and savings until you reach zero. This means that every dollar you earn goes towards a specific purpose: bills, groceries, or savings. By starting from zero, you can prioritize your spending and ensure you only spend on what you need.

Use Budgeting Tools

There are a variety of budgeting tools available that can help you find a flexible budget. These may include apps, software, or spreadsheets that allow you to track your income, expenses, savings, and investments. By using these tools, you can better understand your financial situation and make informed decisions about how to allocate your funds.

Set Realistic Goals

When creating a flexible budget, it’s important to set realistic goals that are achievable within your means. This means considering your income, expenses, and savings goals, and adjusting your budget accordingly. By setting realistic goals, you can avoid overspending and ensure a more stable financial future.

In summary, finding a flexible budget requires a combination of strategies including analyzing your spending habits, considering a zero-based budget, using budgeting tools, and setting realistic goals. By following these tips, you can take control of your finances and achieve a more stable financial future.