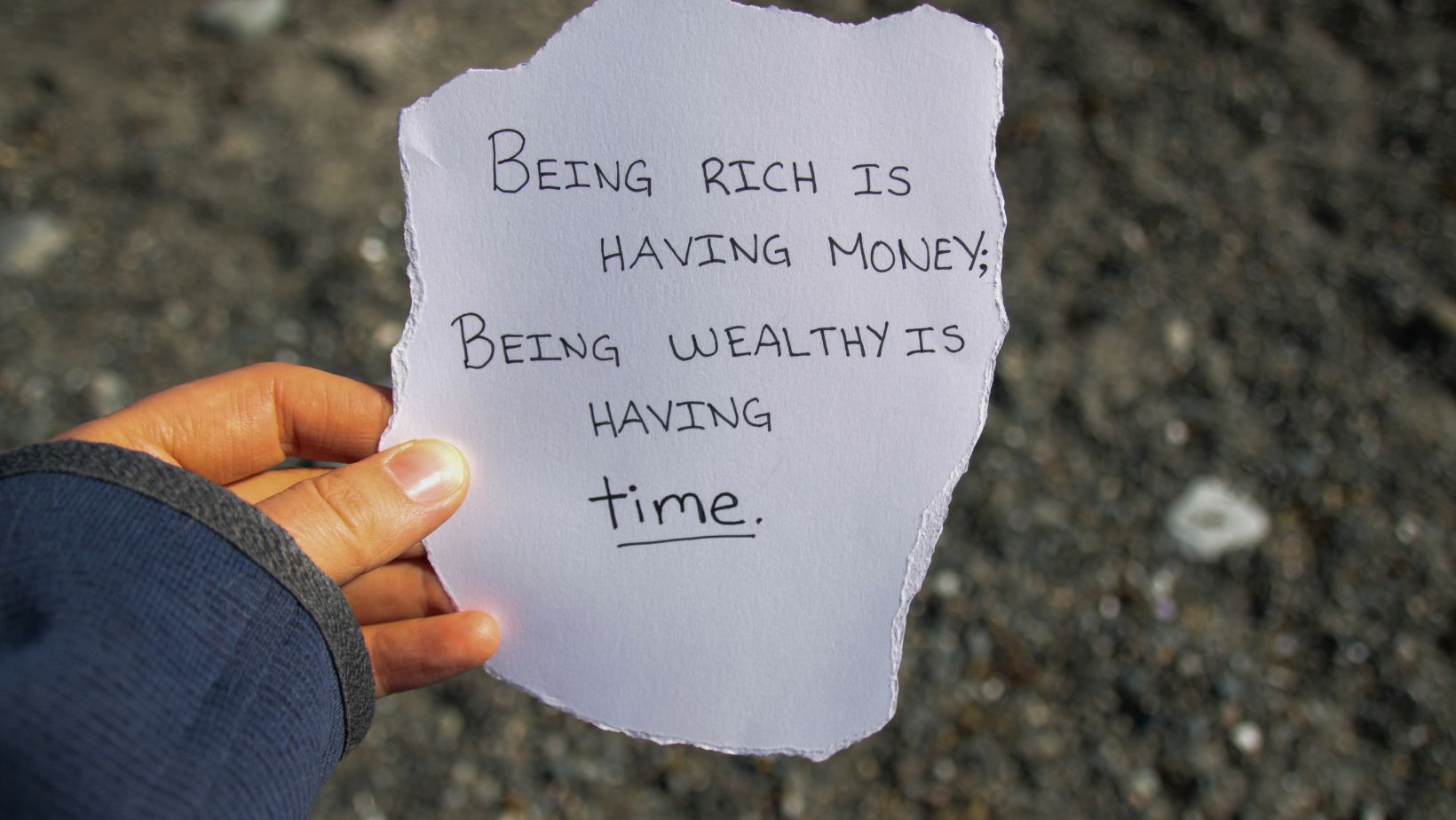

Generational wealth is a concept that has been discussed and debated for ages. It refers to the accumulation of assets, investments, and financial stability passed down from one generation to the next. As I delve into this topic, a particular quote comes to mind: “Wealth is not about having a lot of money; it’s about having a lot of options.” This profound statement encapsulates the essence of generational wealth, emphasizing its true value beyond mere monetary abundance.

When considering generational wealth, it’s crucial to understand that it extends far beyond immediate financial gain. It encompasses the power to create opportunities, provide security, and empower future generations. As someone who delves into personal finance matters regularly, I’ve come across this quote many times in various contexts. Its underlying message resonates strongly with me – that true wealth lies in freedom and flexibility rather than solely in material possessions.

Ultimately, building generational wealth involves more than just accumulating riches; it requires strategic planning, wise investments, and an understanding of how money can be leveraged effectively over time. This quote serves as a reminder that the goal should not be solely focused on amassing fortunes but on creating long-lasting legacies that benefit our loved ones for years to come.

Understanding Generational Wealth

When it comes to generational wealth, there is a quote that resonates deeply with me: “Wealth is not about having a lot of money; it’s about having a lot of options.” This insightful quote encapsulates the essence of generational wealth and highlights its significance beyond mere financial abundance.

Generational wealth refers to the assets, resources, and opportunities passed down from one generation to another. It goes beyond immediate financial gain and encompasses the long-term benefits that can shape the trajectory of future generations. It’s not just about accumulating wealth for personal gratification but about creating a foundation for prosperity that can be enjoyed by your children, grandchildren, and beyond.

One key aspect of generational wealth is the power it holds in breaking cycles of poverty and providing access to better education, healthcare, and opportunities. By building and preserving wealth over time, families can secure their financial future and empower their descendants to pursue their dreams without being hindered by economic constraints.

To understand the impact of generational wealth further, let’s consider an example. Imagine a family that owns substantial real estate investments acquired by previous generations. These properties generate passive income streams that not only sustain the family but also provide funds for educational pursuits or business ventures. This ongoing source of income allows future generations to explore their passions without the burden of student loans or limited resources.

It’s important to acknowledge that creating generational wealth requires careful planning, strategic investments, and sound financial decisions throughout one’s lifetime. Establishing trusts or setting up investment accounts are commonly employed methods for preserving wealth across generations.

Generational Wealth Quote

When it comes to building generational wealth, having a solid investment strategy is key. As the saying goes, “A penny saved is a penny earned.” This quote emphasizes the importance of making wise financial decisions that can lead to long-term wealth accumulation.

One effective strategy for creating lasting wealth is diversification. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can reduce risk and maximize potential returns. This approach allows you to benefit from various market conditions and shields you from the volatility of any single investment.

Another crucial aspect of long-term wealth creation is compounding. Albert Einstein once said, “Compound interest is the eighth wonder of the world.” This insightful quote highlights how reinvesting your earnings over time can exponentially grow your wealth.

Additionally, adopting a buy-and-hold strategy can be highly advantageous in building generational wealth. Warren Buffett famously stated, “Our favorite holding period is forever.” This quote underscores the value of patience in investing and aligns with the philosophy that successful investors focus on long-term growth rather than short-term fluctuations.

Furthermore, staying informed about market trends and economic indicators is essential for making informed investment decisions. As Peter Lynch wisely put it: “Know what you own and why you own it.” Understanding both macroeconomic factors and individual companies’ fundamentals will enable you to make sound judgments when allocating your capital.