Cryptocurrency trading has grown rapidly in recent years, offering a variety of ways to invest and potentially earn profits. One option that has attracted attention is perpetual contracts, a type of trading where you can speculate on the price of a cryptocurrency without actually owning it. This approach allows traders to engage with the market using smaller amounts of money, which can be appealing for those with limited budgets.

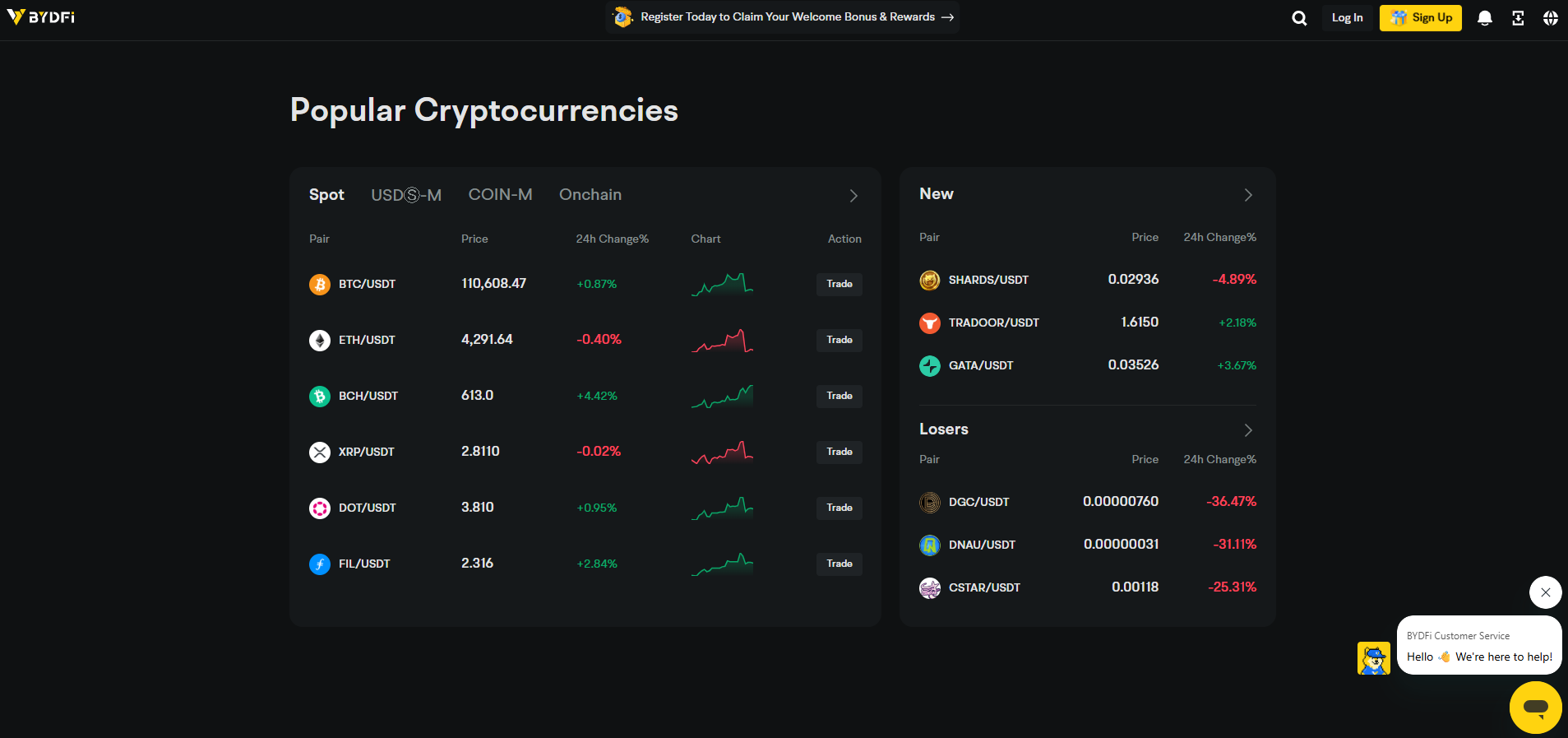

For beginners, platforms like BYDFi perpetual contracts for beginners provide a straightforward way to start exploring this type of trading. They offer user-friendly tools, multiple crypto pairs, and features like demo accounts and copy trading to help new traders understand how perpetual contracts work. With the right guidance and careful risk management, small-budget traders can begin to experience the potential opportunities in this market.

Understanding both the benefits and risks is important before starting. The following sections will explore how perpetual contracts function and what to consider when using them with a smaller budget.

How Perpetual Contracts Work

Perpetual contracts are a type of derivative that allows traders to speculate on the price of a cryptocurrency without owning the actual coin. Unlike regular futures, these contracts do not have an expiration date, which means you can hold a position for as long as you want, provided you meet the margin requirements.

Traders can choose to go long if they believe the price will rise, or short if they expect it to fall. The leverage available can amplify both potential gains and potential losses, so understanding the mechanics is important.

Funding rates are a unique feature of perpetual contracts, ensuring that the contract price stays close to the spot price of the cryptocurrency. Small-budget traders should pay attention to these rates and manage risk carefully.

Potential Advantages For Small Budgets

Perpetual contracts can be appealing for traders with smaller budgets because they allow participation without needing to buy the full amount of a cryptocurrency. By using leverage, even modest investments can access larger positions, potentially increasing returns. This flexibility makes it easier to experiment and learn without committing too much capital upfront.

Platforms like BYDFi provide a user-friendly environment, offering tools and resources to guide newcomers. Demo trading and low minimum requirements help users gain confidence while managing risk.

With careful planning and proper risk management, small-budget traders can explore different strategies, monitor the market, and develop trading skills in a controlled and accessible way.

Risks To Consider

Perpetual contracts come with significant risks, especially for traders with smaller budgets. Using leverage can amplify gains, but it also increases potential losses. A small market movement in the opposite direction can quickly affect your investment.

Beginners should take advantage of demo accounts or practice strategies without risking real money. Understanding market volatility and how leverage works is crucial before committing funds.

Careful planning, setting clear limits, and only investing money you can afford to lose are essential for staying safe while exploring perpetual contracts. Awareness and discipline help reduce the chance of large losses and make the trading experience more manageable for small-budget investors.

Tips For Small-Budget Traders

For small-budget traders, careful planning is essential to make the most of perpetual contracts. Start by using tools like BYDFi, which allows beginners to trade with low minimum amounts. This makes it possible to gain experience without risking large sums. Small amounts like 0.005 btc to usd can help beginners understand position sizing without significant financial exposure.

Set strict limits on how much you invest per trade and consider using stop-loss orders to protect your funds. Diversifying positions and avoiding over-leveraging can also reduce potential losses.

Learning from demo accounts, tutorials, and market research helps build confidence and improves decision-making. By starting small, staying disciplined, and using available trading tools, even traders with limited budgets can explore perpetual contracts responsibly while minimizing unnecessary risk.

Conclusion

Perpetual contracts offer a way for traders to explore cryptocurrency without needing large amounts of capital. They provide flexibility and the chance to practice strategies safely. Platforms like BYDFi make entering the market easier with beginner-friendly tools.

Success relies on careful planning, understanding risks, and using strategies such as low leverage, stop-loss orders, and diversification. Starting small helps build knowledge and confidence over time.

With discipline and the right tools, small-budget traders can gain experience, identify opportunities, and make informed decisions in the fast-moving crypto market. Perpetual contracts can be a valuable part of learning to trade effectively.