Which Of The Following Expenses Would Be A Good Reason To Spend Money From An Emergency Fund?

When it comes to determining which expenses justify using funds from an emergency fund, it’s important to consider the nature of the situation and the purpose of such funds. An emergency fund is typically set aside for unforeseen events or urgent financial needs that cannot be covered by regular income or savings. Therefore, it should be reserved for expenses that are essential and directly related to preserving one’s well-being or financial stability.

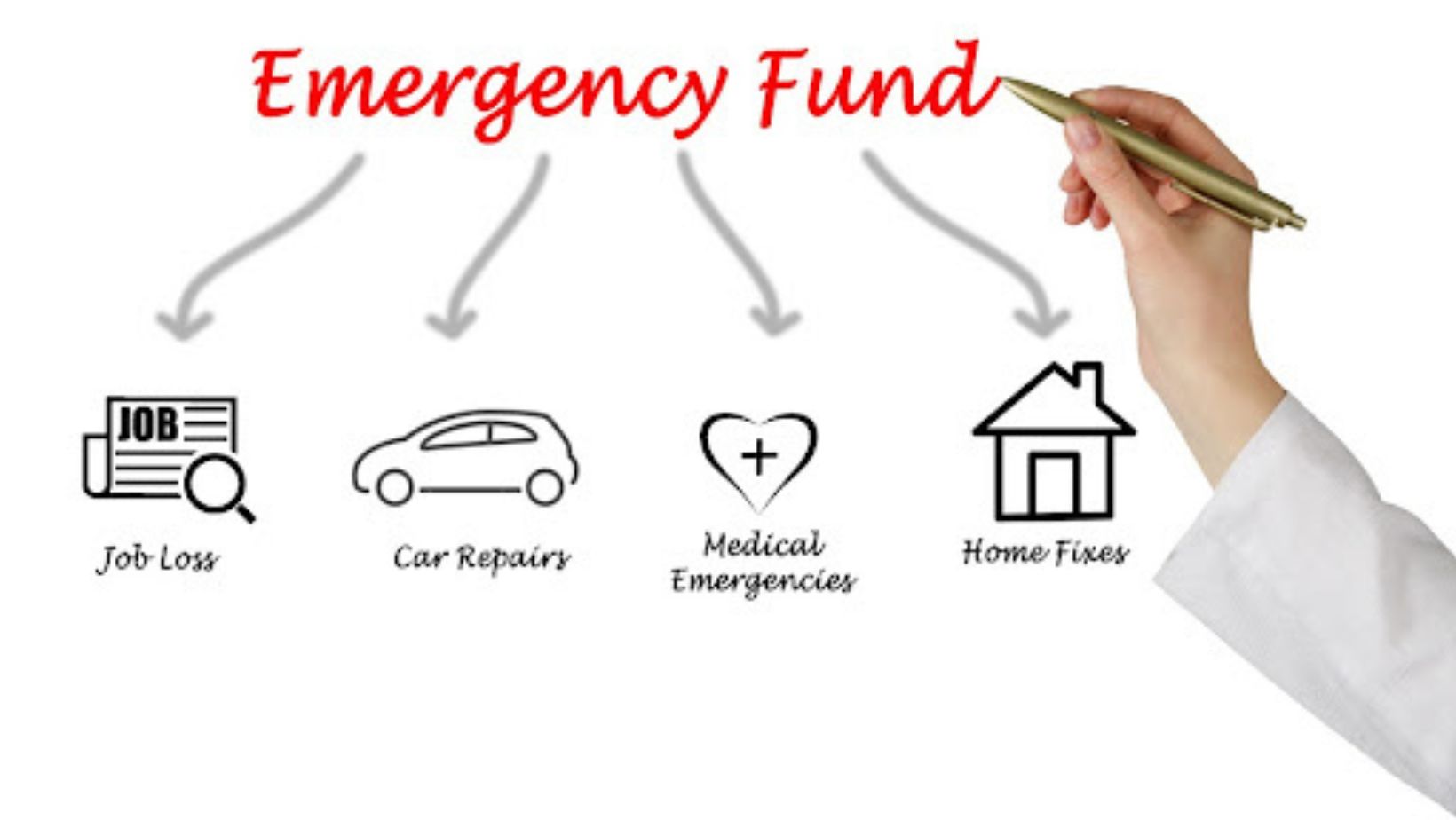

Some common examples of expenses that could warrant tapping into an emergency fund include unexpected medical bills, major car repairs, home repairs due to sudden damage (such as a leaky roof), and loss of income due to job loss or a significant reduction in hours worked. These types of situations often require immediate attention and can have a significant impact on one’s overall financial health.

For more interesting content, check out our next page!

However, it is crucial to exercise caution when considering whether an expense truly qualifies as an emergency. Non-essential purchases, discretionary spending, or routine expenses should not be financed through an emergency fund. It is always wise to evaluate alternatives like adjusting budgets, seeking assistance programs, or exploring other sources of funding before depleting your emergency savings.

Ultimately, the decision of which expenses justify using money from an emergency fund will depend on individual circumstances and priorities. Building a robust emergency fund should be a priority for everyone as it provides peace of mind during uncertain times and serves as a safety net when life throws unexpected curveballs our way.

When it comes to emergency funds, one of the key considerations is determining which expenses warrant tapping into this financial safety net. Medical emergencies are undoubtedly among the top reasons why having an emergency fund is crucial. Let’s delve into why medical emergencies should be considered a good reason to spend money from an emergency fund.

- Unforeseen Healthcare Costs: Medical emergencies can arise unexpectedly, leaving you with hefty bills that you may not have budgeted for. Whether it’s a sudden illness, injury, or unexpected medical procedure, having funds readily available in your emergency fund allows you to cover these immediate healthcare expenses without compromising your financial stability.

- Health Insurance Gaps: Despite having health insurance coverage, there are often deductibles, copayments, and other out-of-pocket costs that need to be paid during a medical emergency. These expenses can add up quickly and put strain on your regular budget. By utilizing your emergency fund, you can bridge these gaps and ensure timely access to necessary medical care without worrying about the financial burden.

- Loss of Income: In some cases, a medical emergency may result in temporary or prolonged absence from work due to illness or recovery time needed post-treatment or surgery. This loss of income can disrupt your financial equilibrium and make it challenging to meet essential expenses like rent/mortgage payments or utility bills. Having an emergency fund allows you to replace lost income during this period and maintain financial stability until you’re back on your feet.

- Unexpected Prescription Medication Costs: Prescription medications can be costly, especially if they’re required for an extended period or if they’re not covered by insurance. During a medical emergency where medication plays a vital role in recovery or ongoing treatment, having funds available in your emergency fund ensures that you can afford these necessary medications without delay.

- Travel Expenses for Specialized Care: Sometimes seeking specialized medical care requires traveling outside of your local area or even internationally. The associated travel expenses, including transportation, accommodation, and meals, can quickly accumulate. By using your emergency fund to cover these costs, you can prioritize receiving the best possible care without worrying about the financial implications.

In summary, medical emergencies are a valid reason to spend money from an emergency fund. From unexpected healthcare expenses and health insurance gaps to loss of income and specialized care travel costs, having funds readily available in your emergency fund provides peace of mind and ensures that you can navigate through challenging times with financial stability.

When it comes to determining which expenses would justify dipping into an emergency fund, home repairs are certainly a category that could warrant the use of these funds. However, it’s important to carefully consider the urgency and severity of the repair before making the decision.