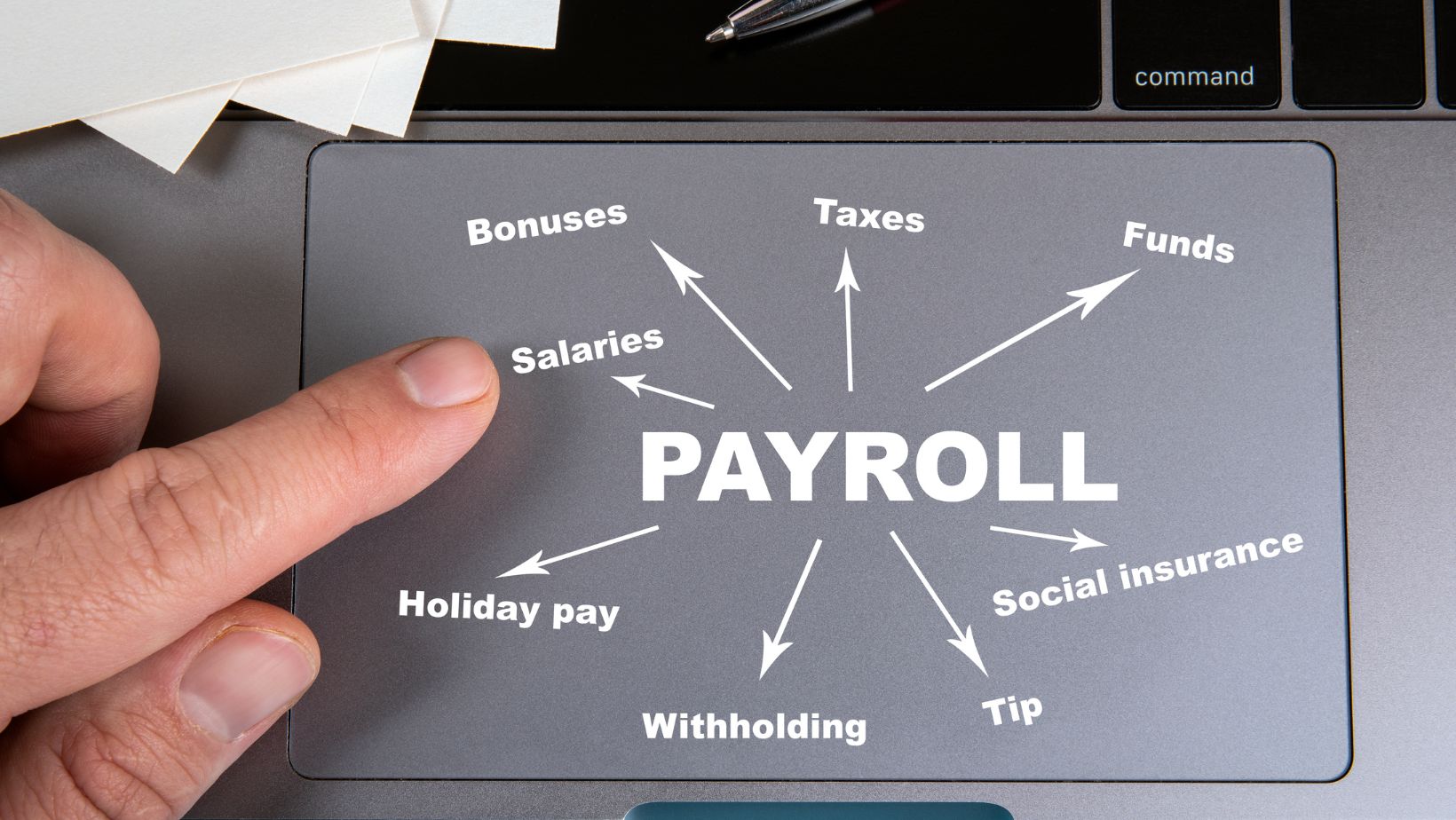

Post PreviewPayroll is a crucial process that requires attention to detail. It is also a key data source for decision-making when growing your business.

Gathering payroll information starts with getting an employer identification number (EIN), establishing state or local tax IDs, and collecting employee forms such as the I-9 and W-4. You must also choose a payroll schedule and comply with all federal and state labor laws.

Gathering Information

A company’s payroll records are a comprehensive list of salaries, wages, bonuses, and taxes the organization pays employees. Keeping an accurate record of these details is vital for a company’s tax compliance and resolving any discrepancies.

To start processing payroll, gathering all the pertinent information is necessary. This includes the employee’s personal details, wage rate, and other information to calculate their gross pay. The gross pay is the total in-hand amount before any mandatory and voluntary deductions, like income tax, provident fund contributions, etc.

Once the payroll data has been collected, it must be entered into the company’s accounting or ERP system. This is when the company will make calculations based on the different components of each employee’s salary package, including their regular wages, overtime, and other perks. Once the payroll has been processed, it must be verified for accuracy before being deposited into the employees’ bank accounts. If there are any mistakes, they should be corrected immediately to ensure the correct amounts are being credited.

Calculating Wages

One of the most important functions a business performs is paying its employees. Whether you’re using paper checks, direct deposit, or prepaid debit cards, you need to be able to accurately calculate employee wages and make sure you’re compliant with local regulations.

For hourly employees, gross pay is determined by the number of hours worked during the payroll period multiplied by an employee’s wage rate. Other factors, like overtime and commissions, may also be included. When salaried employees are paid regularly, their gross pay is calculated by their annual salary and the number of pay periods per year.

It’s also essential to calculate deductions and withholdings from employee paychecks. This ensures you’re withholding the correct amount of income tax and complying with government regulations. With the right tools, payroll processing can be more accessible than ever. Consider an all-in-one employee management solution to streamline your process further.

Paying Employees

Payroll records are essential to any business, allowing you to track all employee payments. This helps to ensure accuracy, reducing the chances of errors and disputes. It also makes complying with labor laws such as break times and overtime easier.

To calculate payroll, you must gather employees’ payroll information, such as personal details, bank account data for direct deposit, and wage information. You will also need to know how much to pay each employee, considering their hourly pay rate or salary and other earnings (such as commissions or bonuses). You will then need to deduct applicable taxes from their gross pay. This can be done using a tax calculator, your state’s resources, or referring to the employee’s W-4 form.

Once you have calculated payroll, you must send the appropriate documents to each employee. You can do this via email or by printing and handing them out in person. You must store employee payroll records securely and restrict access.

Sending Out Pay Stubs

Payroll data can help businesses understand their performance over time and identify recurring errors. For example, if an employee is consistently overpaid or underpaid due to human error, payroll data can help find the source of the issue and rectify it. It can also inform business decisions, from budgeting and cash flow to predicting long-term growth.

A pay stub is a record that shows an employee’s wages for a given period, along with personal deductions, taxes, and company contributions. Most employers attach them to paychecks or deliver them digitally via direct deposit. Employees can also use their paystubs as proof of income when applying for loans or renting an apartment.

The rules for giving employees access to their pay stubs vary by state. Check the Fair Labor Standards Act and your state’s Department of Labor website for more information. In most states that require employers to provide access, an employer may deliver the statement in printed form or offer a printable online version. If your employer isn’t complying with these requirements, you can file a complaint.

Reconciling Accounts

Reconciliation accounting is a standard bookkeeping process that involves matching transactions between a company’s general ledger and the subsidiary sub-ledgers. Cash and vendor statements (balance sheet accounts) are the most common accounts reconciled. Reconciliations are an excellent way to double-check your business’s financial records and catch errors. However, they can be time-consuming if handled manually or without automation features in top online accounting software.

The first step is to analyze the bank statement for the period you’re reconciling. The statement itemizes everything that went into and out of your account during that time frame, allowing you to compare it to your business records.

Differences between your records and the bank statement are common, but not all differences indicate a problem or fraud. Sometimes, the discrepancies are simply due to timing differences or small fees directly assessed in your bank account. Other times, it results from an error the bank or internal staff made that has yet to be caught. In either case, seeing these issues as soon as possible is essential.